You run a gaming platform. Would you rather have twenty new clients or just three?

If you immediately said "twenty," you might want to reconsider.

While this article approaches from the perspective of a platform provider, these core principles transcend across the entire B2B gaming ecosystem—whether you're a payment processor, game aggregator, compliance solution, or CRM provider. The strategic math remains the same: the wrong partners don't just fail to generate revenue; they actively consume resources and derail your focus.

The Allure of Scale

The proposition is tempting: twenty new partnerships mean twenty setup fees, expanded market presence, and impressive growth metrics to present to stakeholders. On paper, it's a win. In practice, it's often where sustainable growth goes to die.

The Hidden Costs of Partnership Proliferation

Before signing that twentieth contract, ask yourself the critical questions that separate visionary growth from reckless expansion:

Do they have genuine growth potential?

Here's the uncomfortable truth: sufficient funding doesn't equal success. We've seen operators with seven-figure war chests flame out spectacularly within six months because they fundamentally misunderstood their market, their competition, or basic unit economics.

This is why the sales process needs rigorous qualification filters, not just credit checks:

- Market & Space Understanding: Can they articulate their competitive positioning beyond "better UX and bonuses"? Do they understand the regulatory landscape they're entering? Can they name their top five competitors and explain what those competitors do well?

- Business Plan Scrutiny: Request their actual business plan and evaluate it critically. What are their customer acquisition cost assumptions? Their projected conversion rates? Their retention models? Most importantly—do their core assumptions match reality, or are they building castles on quicksand?

- TAM Reality Check: If their plan shows capturing 10% of the UK market in year one, ask the hard question: "From whom, specifically?" Are they stealing share from Bet365? Sky Bet? Flutter Entertainment? Or are they banking on mythical "untapped demand" that doesn't exist? Market share comes from somewhere—make them explain where.

- Cashflow Viability: Revenue projections are fiction until money hits the bank. Can they sustain twelve months of operations at their projected burn rate if acquisition costs run 30% higher than planned? What happens when their first marketing channel saturates faster than expected?

Beyond the initial setup revenue, will these partners still be operating at month six? Month twelve? The iGaming graveyard is filled with brands that looked promising in pitch decks but lacked the market understanding, capital reserves, or operational discipline to survive their first regulatory hurdle or their second month of underwhelming CPA performance.

And here's the question nobody wants to face: do you really want to spend your time chasing minimum monthly fees through courts and collection agencies when they run out of money? Because that's where inadequate qualification leads—not to partnerships, but to legal disputes over unpaid invoices.

Can your resources handle the load?

Twenty partners mean twenty different stakeholder calls, twenty competing priorities, and twenty voices demanding your development roadmap bends to their vision. Your account managers become firefighters. Your product team becomes a feature factory. Your strategy becomes whatever the loudest partner demanded last Tuesday.

The Market Diversification Trap

Here's where complexity compounds. Twenty partners rarely mean twenty identical operations—they mean twenty different markets, each with its own technical and commercial requirements:

- Payment Infrastructure: Partner A needs instant banking for the Nordic market, where players expect Trustly-powered deposits that clear in seconds. Partner B is targeting the UK and needs card processing with strong 3DS2 optimization to maintain authorization rates. Partner C requires alternative payment methods (APMs) like PIX for Brazil or MoMo for Vietnam. Partner D insists on crypto payment integration to serve their tech-savvy demographic. Suddenly, your lean payment stack has become a hydra of payment service providers, each requiring separate integration, reconciliation processes, compliance monitoring, and routing logic. Your finance team is managing settlement in twelve different currencies with seventeen different payment partners.

- Game Content: The slots that perform brilliantly in Germany die in Brazil. Your emerging market partners need crash games, fast games, and provably fair mechanics that resonate with crypto-native audiences. Your DACH region partners require land-based inspired mechanics—recognizable fruit symbols, classic bonus features, and games that mirror what players know from their local Spielhallen. Your Nordic partners demand high RTP and high volatility games where players can chase significant wins, along with strong branded content and local jackpot networks. You're now managing content agreements with dozens of suppliers to satisfy divergent market appetites, each with different commercial terms, integration requirements, and certification demands.

- Product Features: Market A needs network jackpots with pooled prize contributions visible across multiple brands to drive player excitement. Market B requires extensive gamification—missions, achievements, progress bars, tournaments—because their player base expects game-like engagement loops. Market C demands sophisticated loyalty programs with tiered VIP schemes, personalized rewards, and exclusive experiences. Market D needs social features and community elements that your platform was never designed to support. Your "core product" is now twenty products wearing the same logo.

- Compliance & Licensing: Each market brings its own regulatory maze. Responsible gambling tools that satisfy the UKGC don't meet Dutch requirements. Your KYC flow needs restructuring for German players. Bonus terms that work in Curacao-licensed markets create legal exposure in Ontario. Your compliance team stops being a center of excellence and becomes a permanent crisis management unit.

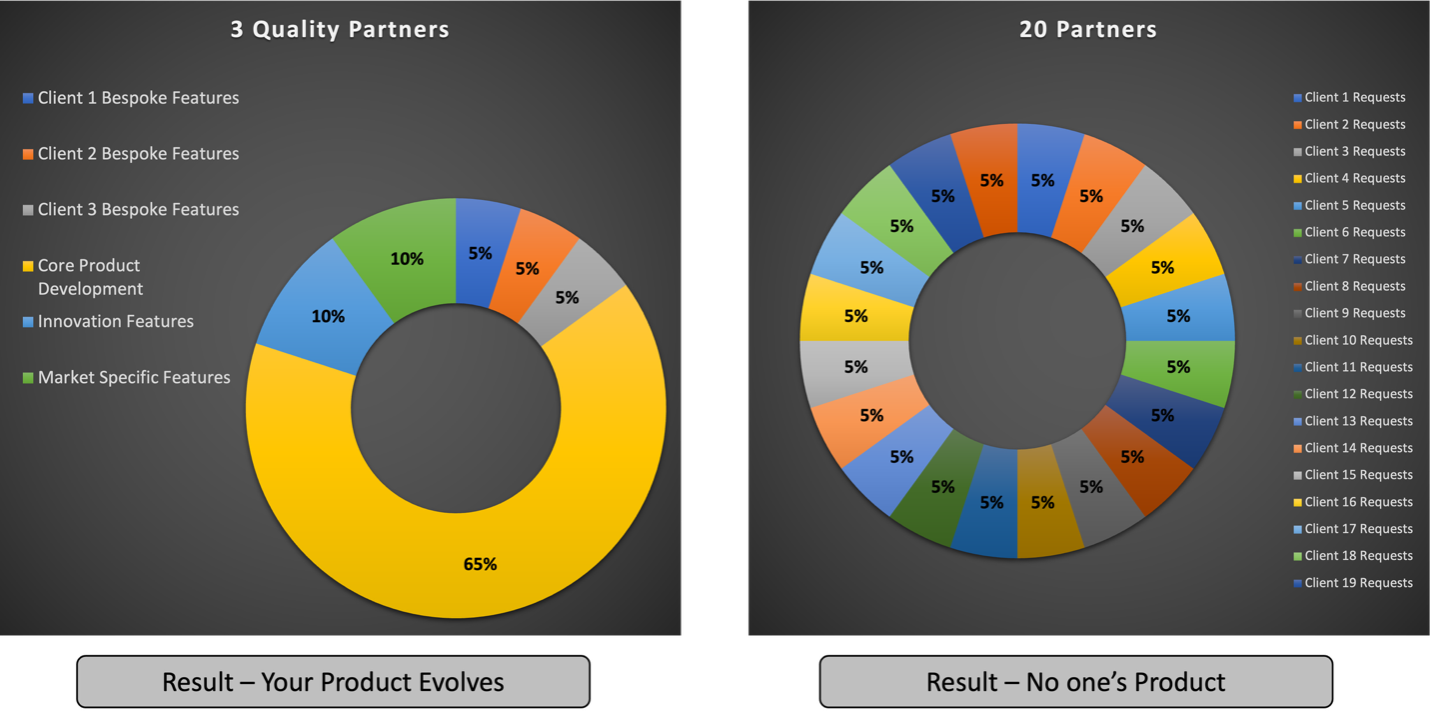

The Strategic Dilution Effect

This is where the real damage occurs. With twenty partners pulling in twenty directions, what happens to your product vision? Your differentiation? Your competitive edge?

You stop building what the market needs and start building what keeps partners from churning. Innovation dies in committee. Your roadmap becomes a wishlist negotiation. Features ship half-finished because resources are spread across too many initiatives. Your platform becomes a Swiss Army knife that does everything adequately and nothing exceptionally.

The Alternative Path

Three to five deeply aligned partners will outperform twenty mismatched ones every time. Here's why:

- Focused Development: You can actually perfect features instead of perpetually pivoting

- Resource Efficiency: Your teams work on meaningful improvements rather than customization projects

- Aligned Incentives: Partners invested in your core vision push you forward rather than sideways

- Market Mastery: Deep expertise in fewer markets beats superficial presence in many

- Sustainable Economics: Long-term revenue from successful partners eclipses short-term setup fees

The Hard Questions

Before expanding your partnership portfolio, get ruthlessly honest:

- Can we genuinely support this many relationships with excellence?

- Do these partners share our vision for where the market is heading?

- Will their success require us to compromise what makes us competitive?

- Are we chasing revenue or building something sustainable?

The right answer might be turning down eighteen opportunities to fully commit to two.

Conclusion

In an industry obsessed with growth metrics and market expansion, the courage to say "no" might be your greatest competitive advantage. Twenty partnerships don't make you a platform leader—they make you a vendor struggling to keep everyone minimally satisfied.

Choose partners who want to build with you, not just license from you. Choose markets where you can genuinely win, not just participate. Choose focus over fragmentation.

Your future self and your shareholders will thank you.

Interested in partnership strategy that prioritizes sustainable growth? Let's talk about building partnerships that compound value rather than complexity.